K-pop isn’t just a global cultural force. K-pop is big business. With companies like HYBE, SM Entertainment, JYP Entertainment, and YG Entertainment listed on Korea’s stock exchange (KRX), fans and investors alike are watching their performance not just on stage, but in financial markets. But which of the “Big 4 agencies” give the best return on investment (ROI)? Here is the K-pop investment guide comparing the return on investment (ROI) of the industry’s Big 4 agencies—HYBE, SM, YG, and JYP—to help you understand which company offers the best financial performance in 2025.

K-Pop Investment Guide: Which Label Gives the Best Return?

An analysis of stock performance, operating profit margins, and revenue breakdowns offers insight into the industry’s key players. Recent headlines—such as HYBE founder Bang Si Hyuk’s IPO controversy—add further context to which agency may be the smartest or riskiest bet. Here is the K-pop investment guide comparing ROI across HYBE, SM, YG, and JYP in 2025.

5-Year Stock Performance (KRX)

Over the past five years, HYBE saw a big surge after its 2020 IPO thanks to BTS, but its stock later dropped due to military enlistments and market concerns. SM Entertainment had moderate growth but faced ups and downs from leadership changes like the Kakao takeover. YG Entertainment’s stock was more unpredictable, rising at times with BLACKPINK or TREASURE activities, but lacking steady momentum. Meanwhile, JYP Entertainment has shown the most stable and consistent stock growth, making it a reliable long-term performer.

Operating Profit Margins

The operating profit margin indicates how much a company earns from its primary business after deducting costs. Among the top K-pop agencies, HYBE has the lowest margin, at 4–8%, due to its high spending. SM Entertainment performs better, with a margin of 14–25%. YG Entertainment is estimated to have a margin of 10–15%. Meanwhile, the strongest performer is JYP Entertainment, with a margin of 24.6%, indicating that it operates efficiently and earns more profit per artist. JYP is the clear winner in profitability.

Revenue Breakdown: Where Does the Money Come From?

HYBE earns a significant portion of its revenue from both direct and indirect artist-related sources. In 2024, HYBE generated ₩1.445 trillion from direct activities, including albums (27%) and concert tours (31%). An additional 42% (₩809 billion) came from indirect channels, including merchandise, licensing, and fan platforms such as Weverse. This shows HYBE’s strong focus on building artist-related IP and fan engagement platforms. (Source: HYBE investor reports)

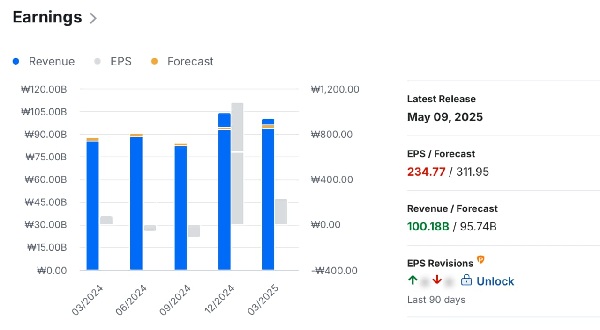

SM Entertainment shows a more balanced revenue structure. In Q1 2025, albums and digital music accounted for 41% of its revenue, while concerts contributed 24%, and merchandise and licensing brought in another 24%. This even distribution highlights SM’s steady approach to managing both content production and fan-related goods. (Source: SM IR 1Q25 Presentation)

YG Entertainment does not release detailed breakdowns. However, it is believed to rely more heavily on traditional streams, such as physical album sales and concert tours. Compared to HYBE or SM, YG has fewer high-margin platforms, such as fan apps and merch licensing, which may impact its overall profitability.

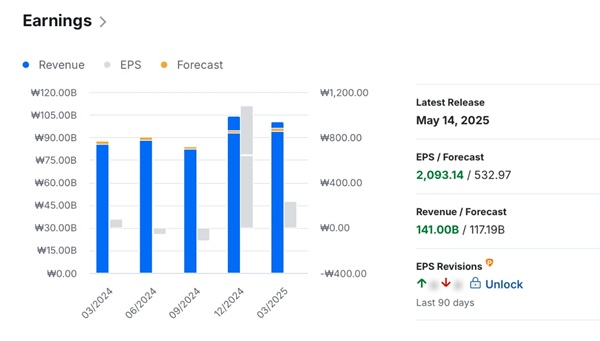

JYP Entertainment is also less transparent with revenue details, but its consistently high profit margins suggest a focus on efficient revenue streams, such as music licensing and digital content. The company likely benefits from lower operational costs and high returns from a smaller but highly successful roster of artists.

Summary: ROI, Risk, and Reward

HYBE has high growth potential, especially with BTS and its fan platform, Weverse. However, its profit margins are low, and the business relies heavily on a few top artists, making it a high-risk investment. Furthermore, in July 2025, HYBE founder Bang Si-hyuk was officially referred to Korean prosecutors for alleged securities fraud related to HYBE’s IPO. Authorities claim that he misled early shareholders and profited significantly when the company went public, resulting in a major governance and trust crisis. While HYBE has pledged to cooperate and is focusing on BTS’s highly anticipated 2026 comeback, the scandal has already shaken investor confidence.

As a result, the stock price dropped, and fan backlash could impact future group promotions and merchandise sales. For investors, this raises serious red flags around HYBE’s leadership, transparency, and long-term stability.

On the other hand, SM Entertainment offers moderate returns with solid profit margins. It operates a well-balanced business with steady revenue from albums, concerts, and merchandise. The company has experienced some management shifts in recent years, but overall risk remains moderate. SM is a safer choice for investors seeking stability with some room for growth.

YG Entertainment has lower-to-moderate ROI and profit margins. Its business is less diversified, relying more on traditional income sources, such as physical albums and concerts. Without strong digital platforms or a broad merchandising strategy, YG carries a medium risk and less investor appeal compared to the others.

Meanwhile, JYP Entertainment stands out with the most stable and high return on investment. It runs a lean and efficient operation, consistently achieving the highest profit margin (around 24.6%). With fewer artists than HYBE or SM, JYP still earns more per artist and keeps costs under control. This makes it a low-risk, high-return choice for investors.

For those looking to invest in the business behind the music, numbers—and not just fan loyalty—should drive the decision.

Join us on Kpoppost’s Instagram, Threads, Facebook, X, Telegram channel, WhatsApp Channel and Discord server for discussions. And follow Kpoppost’s Google News for more Korean entertainment news and updates.